What is Fiscal Deficit?

Last Updated On -26 Aug 2025

Fiscal deficit is the most significant measure of the financial health of a nation. It is the difference between the total expenditure and total revenue (not including borrowings) of the government during a particular financial year. To put it simply, when the government spends more than it receives, the deficit is referred to as a fiscal deficit. This deficit is typically financed by borrowing funds from domestic or overseas sources. Knowing fiscal deficit is important for commerce students, policy makers, and economics professionals since it determines how effectively a country is keeping track of its resources and liabilities.

What is Fiscal Deficit?

Fiscal deficit arises when government spending is more than the total of its revenue receipts (such as taxes, duties, and fees) and non-debt capital receipts (such as disinvestment). Fiscal deficit emphasizes the reliance of the government on borrowing to finance its spending. Fiscal deficit differs from a mere budget deficit since it incorporates interest outgo, subsidies, and the cost of development, and hence it is a better measure.

Formula for Fiscal Deficit:

Fiscal DeficitTotal Expenditure - (Revenue Receipts + Non-Debt Capital Receipts) |

For example, if a government spends ₹50 lakh crores in a year but earns only ₹40 lakh crores from taxes and non-debt receipts, the fiscal deficit is ₹10 lakh crores.

Key Features of Fiscal Deficit

- Represents borrowing needs: This shows how much money the government needs to borrow to fund its operations.

- Indicator of economic health: A high deficit signals rising debt, while a moderate deficit can stimulate growth.

- Measured as a Percentage of GDP: This ratio helps compare fiscal deficits across countries.

- Covers Both Development and Non-Development Expenses: Includes infrastructure, defense, subsidies, and welfare schemes.

Key Causes of Fiscal Deficit

There are several contributing factors to the rising fiscal deficit, such as:

- High Government Expenditure: On defense, infrastructure, and welfare programmes.

- Declining Revenue Collections: Due to economic slowdown, tax evasion, or a low tax base.

- Burden of Subsidies: Subsidies on fertilizer, food, and fuel raise expenditure.

- Debt Repayment: Interest on past borrowings absorbs a sizeable proportion of revenue.

- Unforeseen Spending: War, pandemic, or natural disasters impose unbudgeted expenses.

Tools Employed by Governments to Control Fiscal Deficit

Central banks and the finance ministry employ various measures to manage fiscal deficit:

- Monetary Policy: Regulating interest rates to manage spending and borrowing.

- Tax Reforms: Wider tax base and enhancing compliance.

- Expenditure Management: Reduced wasteful expenses and unnecessary subsidies.

- Borrowings & Bonds: Borrowing funds from domestic or foreign investors.

- Disinvestment: Unloading government shares in public sector undertakings.

Implications of Fiscal Deficit

Positive Effects:

- Stimulates short-term economic growth by accelerating expenditure.

- Finance development activities that lead to employment opportunities and the construction of infrastructure.

Negative Impacts:

- Too much borrowing can result in bad debt.

- Causes inflation if deficit financing is achieved through monetization.

- Decreases investor confidence in the economy.

- Overburdens future generations with repayment.

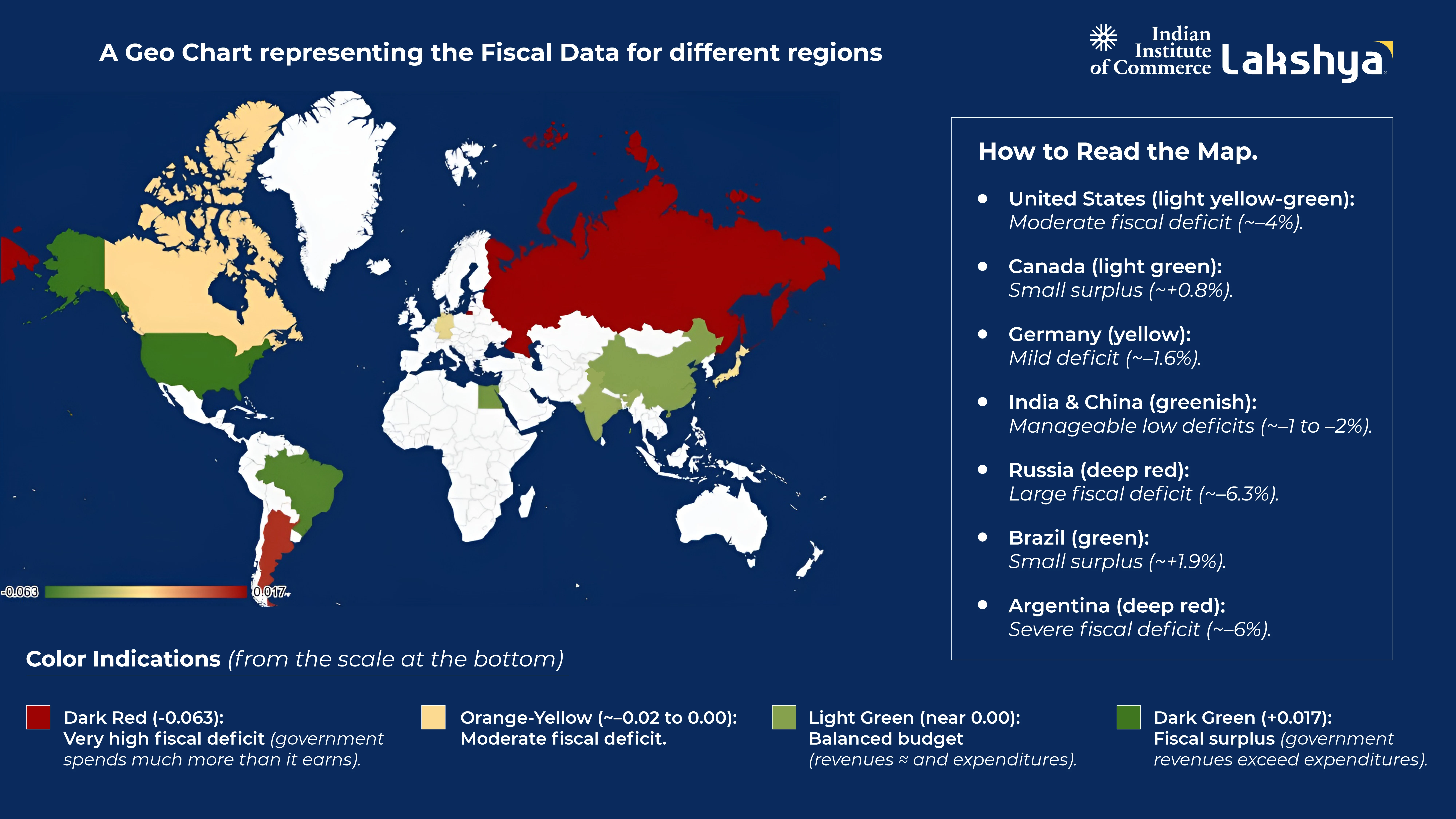

Geographical Analysis for Fiscal Deficit

The fiscal deficit is one of the most important indicators for a country’s financial health. It represents the gap between the government’s total expenditure and its total revenue (excluding borrowings). When the country spends more than it earns, the shortcoming is met through borrowing, which leads to a fiscal deficit. While the fiscal deficits are often necessary for growth and development, excessive and prolonged deficits can destabilize an economy, lead to inflation, and increase debt dependency.

Here’s a tabulation of the fiscal data country-wise:

Country |

Fiscal Data |

|

United States |

-6.30% |

|

Canada |

-2.10% |

|

Germany |

-2.80% |

|

India |

-4.40% |

|

China |

-4.80% |

|

Japan |

-2.50% |

|

Egypt |

-5.10% |

|

Africa |

-5.40% |

|

Brazil |

-5.80% |

|

Argentina |

0.86% |

|

Russia |

1.70% |

North America

United States: The United States always has a high fiscal deficit as it spends heavily on defense, healthcare, and social security. The COVID-19 pandemic further increased the deficit because the government had to boost stimulus packages. The United States funds its deficit by selling Treasury Bonds, which are global safe-haven assets.

Canada: Canada has a comparatively balanced fiscal deficit with significant emphasis on balancing welfare and economic stability. In the post-pandemic period, it increased healthcare and energy transition expenditures but has established specific fiscal objectives to curb deficits in the long run.

Europe

European Union (EU): The Maastricht Treaty requires that the fiscal deficit of EU nations remain below 3% of GDP. Yet nations such as Greece, Italy, and Spain have frequently experienced wider deficits because of welfare obligations, excessive debt, and weak growth.

Germany: Germany is famous for its "Schwarze Null" or Black Zero policy that focuses on zero fiscal deficit. But even in times of crises like COVID-19, Germany relaxed the policy temporarily to help businesses and consumers.

Asia

India: India's fiscal deficit is generally on the higher side, tending to be between 5–7% of GDP. Such extensive spending on subsidies, infrastructure, defense, and welfare programs is the reason. Disinvestment, GST reforms, and foreign borrowing are the instruments used by the government to contain it.

China: China utilizes deficit financing strategically to support large-scale investment projects and sustain growth. Contrary to Western economies, the deficit spending of China is usually aimed at state investments to guarantee productive returns. Increasing debt levels at the provincial/local government levels are becoming a concern.

Japan: Japan has a world-leading fiscal deficit and debt-to-GDP ratio. Japan's government has had to borrow for decades because of low growth and high welfare expenses (due to population aging). But the Japanese manage it through domestic bond markets, as the majority of debt is held by residents.

Middle East

Oil-rich nations like Saudi Arabia, the UAE, and Qatar experience fiscal deficits when global oil prices fall, as their revenues are highly dependent on petroleum exports. Many of these countries are now diversifying into non-oil sectors to stabilize revenue and reduce future deficits.

Africa

Many African economies face persistent fiscal deficits due to limited tax revenue, heavy dependence on imports, and large developmental expenditures. Countries like Nigeria and South Africa struggle with deficits caused by volatile commodity prices, corruption, and high public sector costs.

Latin America

Brazil: Brazil’s fiscal deficit remains high due to pension obligations and welfare spending. Inflation and currency depreciation often worsen the fiscal situation.

Argentina: Argentina frequently suffers from fiscal crises. Chronic deficits, currency collapse, and reliance on the IMF for bailout packages highlight the structural weaknesses in its economy.

Is there any difference between the Fiscal Deficit and GDP?

While fiscal deficit and GDP are two different notions, they are linked concepts. GDP, which stands for Gross Domestic Product, is the total value of final goods and services produced within a country. This value provides insight into the size and health of an economy. Fiscal deficit, on the other hand, is the difference between government spending and government revenue (excluding borrowings). This amount is an important indication of how much borrowing is needed for government activities. The focus of GDP is national output, and the focus of improvement of the fiscal deficit is spending outside of government revenue. These two concepts are connected as well. Normally, we correlate the fiscal deficit and GDP amount as a percentage increase. Even nowadays, comparing government borrowing to GDP is useful in assessing the sustainability of government borrowing related to the strength of an economy.

Read More

Frequently Asked Questions (FAQs)

Is the fiscal deficit harmful all the time?

Not at all times. A moderate fiscal deficit can stimulate economic growth, but a consistently high level can lead to inflationary impetus and problems relating to debt.

Fiscal deficit and budget deficit are different, how?

The budget deficit calculates revenue per expenditure, and the first only calculates a shortfall, while fiscal debt measures what is owed, or policy and performance as a function of borrowing and servicing previous borrowings.

Who controls the fiscal deficit in India?

The Ministry of Finance formulates the budget, and the Reserve Bank of India (RBI) controls borrowing.

Why should commerce students consider fiscal deficit?

Fiscal deficit is a macroeconomic aspect of commerce concerning its work in finance, economics, management, and business generally.

Who has contributors with the hardest study on the fiscal deficit?

Public Finance, Macroeconomics, Government Budget, and theory.

.webp)