Kinked Demand Curve

Last Updated On -29 May 2025

The market structures have a great influence on the responsiveness and behaviour of firms with respect to the pricing. This is where oligopoly comes into the picture, how a market is dominated by large firms. The kinked demand curve offers a peak into how the prices remain rigid in the market, even after the condition changes. The blog will take you to the concept in detail, and help you understand the reasons behind price stability and demand.

What is the Kinked Demand Curve Theory?

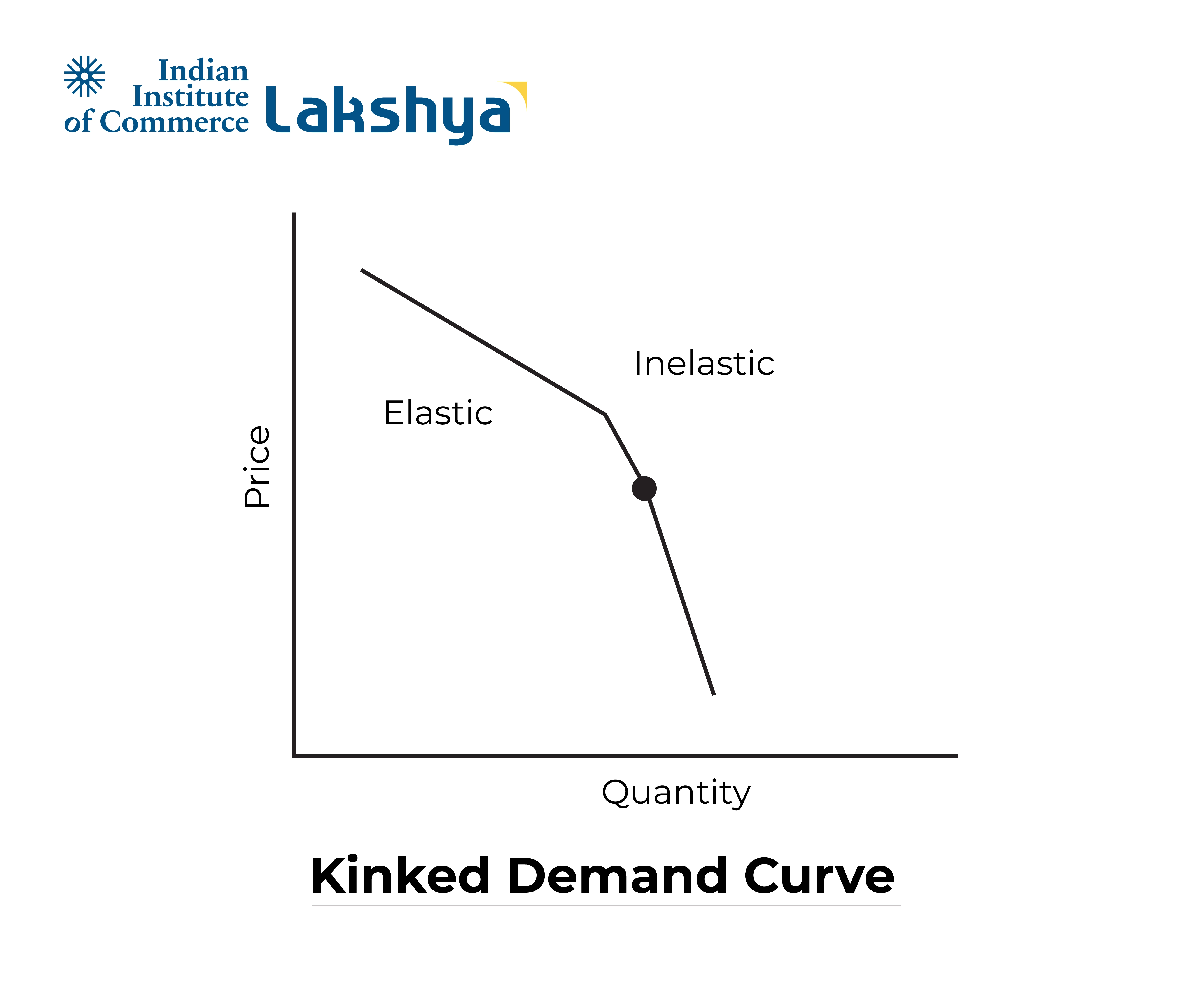

The kinked demand curve is similar to the traditional downward sloping demand curve being a common point. According to classical economic theory, a kinked demand curve is a graphical representation which is used in oligopoly markets for the explanation behind the stability of prices over time. In oligopoly markets, a kinked demand curve is a graphical depiction used to illustrate why prices can remain constant over time. With a "kinked" curve—that is, a steep bend or corner—the current market price determines Whereas the lower part of the curve (below the kink) is inelastic, the top section (above the kink) is rather more elastic. In an oligopolistic market, this unequal elasticity produces odd price-output behaviour across companies.

Economist Paul Sweezy invented this concept in 1939. His idea aimed to explain why, in oligopolistic marketplaces, prices do not change often even in cases with varying marginal costs. The kinked demand curve reveals that companies have a disincentive to either increase or decrease prices since the competitive responses from competing companies usually cancel any possible benefit.

Key Points about the Shape of the Kinked Demand Curve

Unlike in ideal competition, the kinked demand curve is not a clean, straight-line curve.

Rather, the kinked demand curve consists of two separate parts:

- Upper Segment: Above the current price, the upper segment is rather elastic since if one company increases its pricing, others will not follow. The company can thereby lose a good number of clients to rivals.

- Lower Segment: (Below the existing price), this is inelastic since, should a company cut its price, rivals will match the cut to prevent losing market share and the company will either earn very little to none advantage.

This produces a "kink" at the current price that results in a discontinuous marginal revenue curve. Understanding pricing rigidity in oligopolistic markets requires one to grasp this discontinuity.

Kink Point – Price Rigidity

The kink in the demand curve represents the current market price and output level. At this point, firms believe that:

- If they increase the price, rivals won’t follow, leading to a sharp fall in demand (elastic upper segment).

-

If they decrease the price, rivals will match the cut, leading to a small gain in market share (inelastic lower segment).

Upper Segment – More Elastic

Above the kink, the demand curve is relatively elastic.

- A small increase in price causes a large drop in quantity demanded.

-

This is because consumers may shift to competitors.

Lower Segment – Less Elastic

Below the kink, the demand curve becomes relatively inelastic.

- A decrease in price doesn't increase demand much.

-

All firms reduce prices together, so no firm gains a major advantage.

Applies in Oligopoly

This model is especially useful in oligopoly markets, where:

- A few dominant firms exist.

- Firms are interdependent in their pricing strategies.

-

Price wars are generally avoided.

Key Features of the Kinked Demand Curve Theory

Understanding why prices often remain constant in oligopolistic systems requires a strong economic tool—the kinked demand curve. Its special structure and consequences serve to clarify firm behaviour in highly unpredictable and interdependent environments. It remains a fundamental idea in microeconomics and market structure theory even if it is not without problems.

The kinked demand curve model requires some assumptions to be functional:

- Few Sellers: A small number of powerful companies predominate in the market.

- Interdependence: Firms watch and respond to one another's price choices in interdependence.

- Rigidity in price: Companies feel that raising prices will result in a loss in sales and that lowering prices would start a pricing war.

- No frequent change in price: Prices do not often vary in reaction to little cost fluctuations.

- Lack of information: Companies have partial knowledge about the cost structures and strategies of rivals.

- Non-price competition: Companies want to maintain prices steady in order to minimise unneeded risk or reprisals.

- Discontinuous Prices: Since price cuts are forbidden, companies compete using advertising, branding, and customer service.

- Discontinuous MR Curve: The output decision of the firm is not affected by any range of marginal cost variations.

- Strategic Behaviour: Companies are wary and base their decisions on likely reactions of competitors.

Real-Life Examples of Kinked Demand Curve

- Airlines industry: Although rival airlines are known to swiftly match price decreases, they are reluctant to raise pricing separately.

- Telecom industry: The telecom industry usually provides similar rates. Almost soon, a cut in tariff by one entity is matched by others.

- Soft Drink Market: Price wars are hardly ever fought by Coke and Pepsi. Their emphasis now is largely on branding and advertising initiatives.

These sectors exhibit classic oligopoly behaviour, in which the kinked demand curve finds most relevance.

Drawbacks for the Kinked Demand Curve Theory

Companies in such marketplaces concentrate more on brand loyalty and product uniqueness than on price lowering.

Knowing this idea improves not only your comprehension of theoretical economics but also facilitates the interpretation of the strategies applied by major companies in practical sectors.

The kinked demand curve idea has certain drawbacks even if it is quite useful:

- It merely addresses price rigidity, not how the original price was determined.

- Assumptions are idealistic; actual markets might not respond exactly as projected.

- Ignores Dynamic Pricing where the companies may employ cutting-edge techniques to regularly adjust prices in the data-driven environment of today.

- No Universal data is used. The idea is exclusive to oligopolistic marketplaces and could not be applicable in monopolistic or totally competitive contexts.

Read More

Discover what you didn’t know you needed to know. Read our Commerce Topics Right Now!

Frequently Asked Questions (FAQs)

What explains using a kinked demand curve?

In an oligopolistic market, when companies are unwilling to modify prices out of concern of competitive reaction, the kinked demand curve helps to explain pricing rigidity.

Why in the kinked demand model is the marginal revenue curve discontinuous?

The marginal revenue curve shows a vertical gap due to the varied elasticities above and below the kink, therefore indicating a range of marginal cost adjustments unrelated to output or price.

Does the kinked demand curve have any bearing today?

Indeed, especially in sectors like airlines, telephone, or fast food, where companies closely track one another's pricing and hardly alter rates by themselves.

.webp)