Why is ACCA getting Popular in India?

Last Updated On -02 Mar 2026

The reason why ACCA is getting popular in India is because of various reasons such as the increasing demand globally and the wide range of opportunities it comes with. Before we get into these questions let's understand what ACCA is. The Association of Chartered Certified Accountants (ACCA) is a leading international accountancy body that offers the prestigious designation of a Chartered Certified Accountant qualification. With over a century of history, ACCA has grown to over 241,000 members and 542,000 students worldwide. The course of ACCA provides a strong foundation in accounting, finance, and management, and is recognized in many countries. In India, the ACCA course is considered equivalent to CA, and ACCA professionals are often hired at similar salary packages in many top international companies.

Career Growth and Job Opportunities after completing ACCA in India

Does ACCA have scope in India? Yes, it does. Securing a career path that is promising and has wide avenues of growth is essential for professionals seeking stability and ACCA does just that. Professionals equipped with the prestigious Association of Chartered Certified Accountants (ACCA) qualification, a world of opportunities awaits.

Want to learn more why ACCA is popular, click quickly!

5 Reasons why ACCA is getting popular in India?

Listed below are a few reasons for ACCA getting popular in India:

- ACCA, as a course, encompasses various aspects of Chartered Accountancy, including Accounting, Financial Reporting, Auditing, Taxation, Business Finance, and Financial Management.

- From finance to management roles, ACCA professionals are highly sought after by a multitude of industries globally. The average ACCA salary in India starts from ₹12 lakhs in India and outside India, it starts at USD 60,000.

- Governmental organizations and regulatory agencies employ ACCA specialists to perform financial oversight and compliance duties. Additionally, the qualification provides access to training positions, non-profit organizations, academia, and entrepreneurship.

- There are numerous potential jobs that an ACCA professional can look forward to.

- It offers a versatile skill set and with ability to solver problems, knowledge about different kinds of problems and adaptibility towards any situation in real world.

Scope and Job Options after completing ACCA in India

The job options after completing ACCA in India are listed below:

- Financial Accountant

- Management Accountant

- Tax Accountant

- External Auditor

- Internal Auditor

- Financial Analyst

- Financial Controller

- Business Consultant

- Treasury Manager

- Risk Manager

- Financial Advisor

- Chief Financial Officer (CFO)

- Forensic Accountant

- Investment Analyst

- Financial Planning and Analysis Manager

The practical skill set and worldwide recognition open up many profitable and significant career options. ACCA in India performs well in positions like financial analysts, risk managers, and strategic advisors, and many more in various domestic and multinational firms. Answering the question ‘Does ACCA have scope in India’, we would say that anybody who looks up and sees a future in Accounting and finance needs not look any further, as ACCA can be the best certification that they're looking for.

What are the Eligibility Criteria for ACCA?

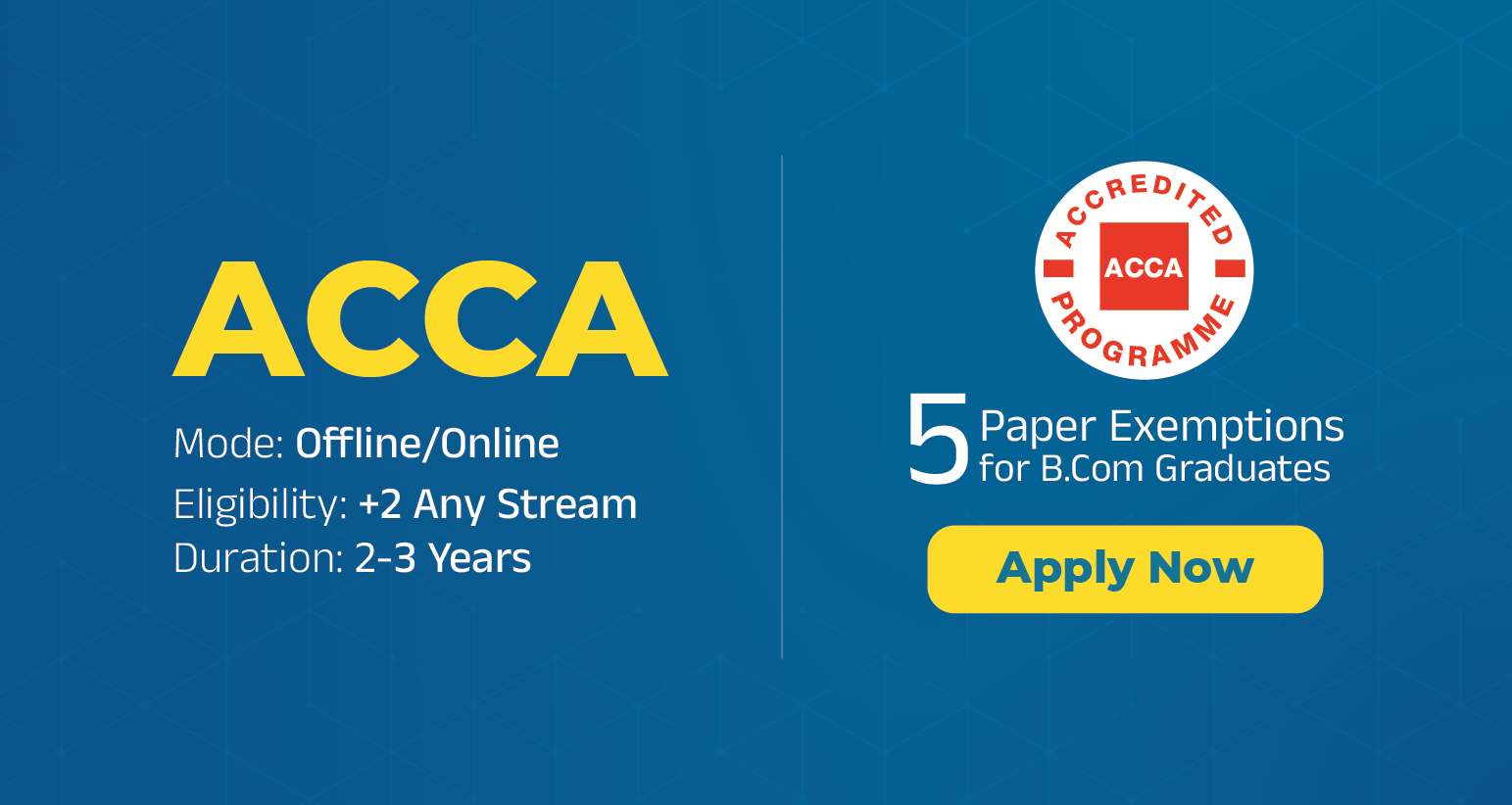

The ACCA eligibility apply to those students who have completed higher secondary, +2 and are looking to embrace global opportunities in Finance. The demand for ACCA in India among professionals is also because ACCA provides a varied degree of exemptions based on the Degrees that an aspirant may have undergone. Graduates and postgraduates aspiring for a career in Accounting and Finance are also eligible.

Given below is a detailed ACCA course eligibility:

|

DEGREE |

EXEMPTIONS |

SUBJECTS EXEMPTED |

|

BBA |

3 Exemptions |

(BT, MA, FA) |

|

B.Com |

5 Exemptions |

(BT, MA, FA, LAW, TX) |

|

CA Intermediate without Graduation |

5 Exemptions |

(BT, MA, FA, TX, AA) |

|

CA Intermediate + Graduation |

6 Exemptions |

(BT, MA, FA, LAW, TX, AA) |

|

Qualified CA |

9 Exemptions |

(BT, MA, FA, LW, PM, TX, FR, AA, |

Read More:

- ACCA Course Fee in India

- What Degree is the best with ACCA?

- ACCA vs CFA vs CA

- Exemptions Calculator for ACCA

Frequently Asked Questions (FAQs)

Is ACCA in Demand in India?

Yes, there is a high demand for ACCA in India, particularly in this time of the globalized world, as more and more international and multinational businesses are opening offices here. ACCA professionals are in high demand across a range of industries including finance, taxation, and consulting.

Do the Big 4 hire ACCA in India?

Yes, the Big Four accounting firms hire ACCA specialists from India all year long. ACCA-certified professionals are suited for roles like audit, taxation, and other areas. This is due to the broad skill set and global perspective that ACCA professionals acquire during their ACCA certification journey.

What does ACCA stand for?

The Association of Chartered Certified Accountants (ACCA) is a globally recognized certification in accounting, finance, and business management. It equips professionals with skills needed for roles like financial management, audit, taxation, and business advisory services.

How many levels are there in the ACCA Course?

The ACCA Course consists of three levels: Knowledge, Skills, and Professional. Each level covers essential topics such as financial reporting, taxation, audit, and advanced financial management.

How long does it take to complete the ACCA course?

The ACCA course duration can vary from 1 to 7 years, depending on the individual's prior qualifications and the pace at which they complete the exams. The course is structured into three levels: Knowledge, Skills, and Professional. The majority of students complete the course between 18 months and 3 years.

What job opportunities are available after completing the ACCA qualification?

ACCA qualification opens doors to a variety of roles in the fields of accounting and finance. Job roles include Accountant, Auditor, Finance Manager, Business Analyst, Taxation Expert, and even positions like Chief Financial Officer (CFO). The ACCA Careers portal lists over 25,000 live vacancies globally, indicating a strong demand for ACCA professionals.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

salary.jpg)

.webp)

.webp)

.webp)