ACCA vs CPA - Which is the better option for you?

Last Updated On -02 Mar 2026

Job seekers intending to make a career in accounting often look out for two well-known certifications that are globally recognised - the ACCA course (Association of Chartered Certified Accountants) or CPA (Certified Public Accountant). From healthcare and hospitality to banking and retail, from the Big Four to other leading private and public firms, accountancy credentials like ACCA and CPA offer limitless roles and a rewarding, versatile profession. However, when choosing one of the two, candidates are often baffled by the ACCA vs CPA discussion and which one is better.

ACCA or CPA - Which is Better?

When deciding which is better ACCA or CPA, it is important to first know what these two credentials are.

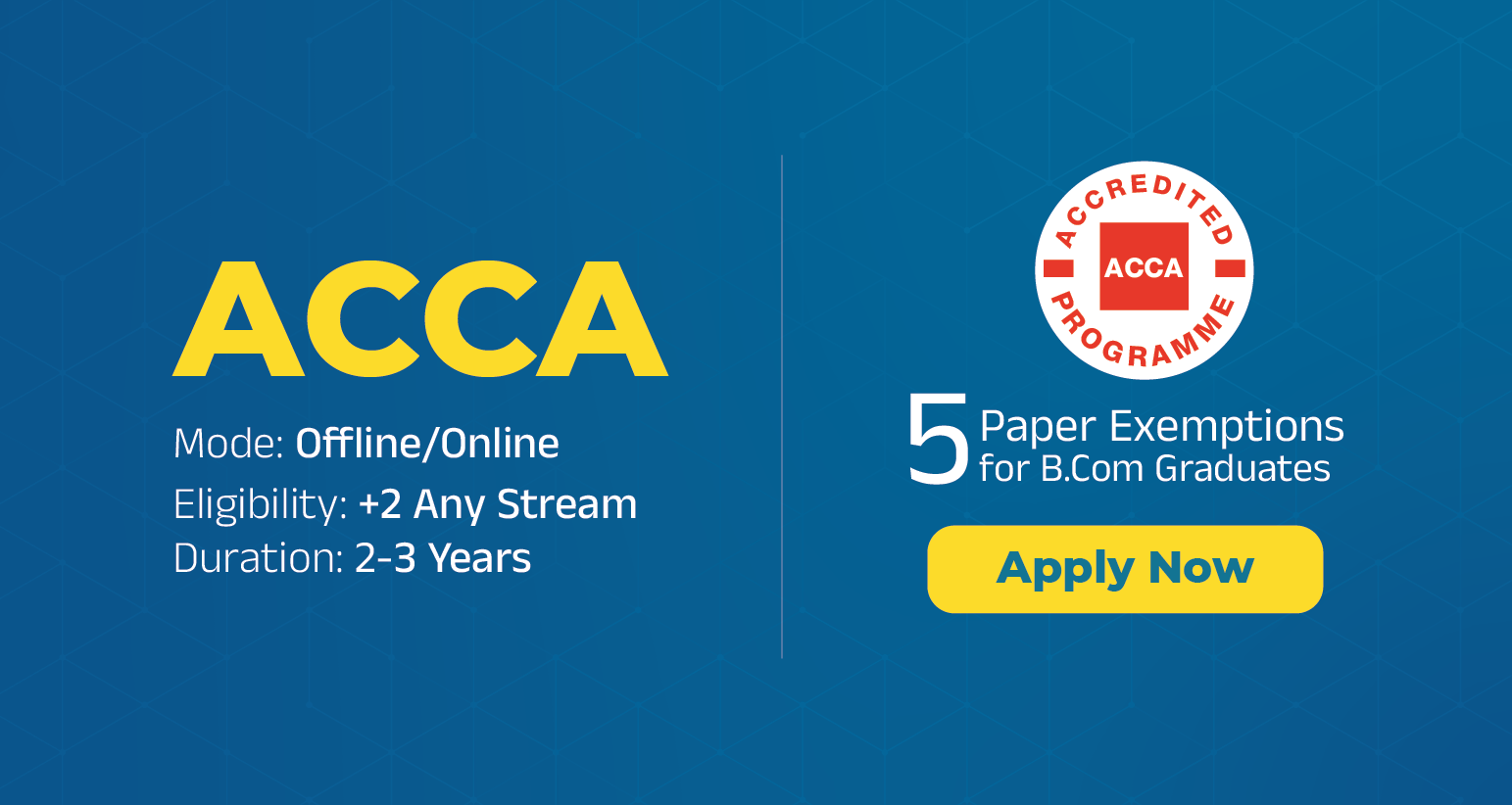

What is ACCA?

The Association of Chartered Certified Accountants is an accounting body based in London, United Kingdom. It authorizes professional accountants all over the world and grants one of the leading accountancy credentials to finance professionals.

Students with the ACCA credential gain comprehensive accounting skills and knowledge; from financial accounting, management accounting and taxation to business ethics and auditing.

What is CPA?

The Certified Public Accountant (CPA) certification is granted to authorized accounting professionals by the Board of Accountancy for each state in the United States of America. In India and many other countries, the Chartered Accountant (CA) credential is at par with the CPA credential.

The CPA (US) syllabus covers reporting and financial accounting, concepts of attestation and auditing, regulatory features like business ethics and law, conceptions like corporate governance, taxation, financial and operations management, and strategic planning. Students can further become CPA Canada, after completing the US CPA.

Stream the ACCA vs. CPA verdict in under four minutes!

What is the difference between ACCA and CPA?

Although ACCA as well as CPA are credentials related to accounting, there are certain differences between the two. We will discuss ACCA vs CPA based on various characteristics. The table given below might help you answer which is better, CPA or ACCA.

|

Feature |

ACCA |

CPA |

|

Examination |

13 papers |

4 papers |

|

Course Duration |

3-4 years |

12-18 months |

|

Accreditation |

Internationally recognized |

Primarily US-focused |

|

Exam Dates |

Throughout the year |

Specific windows |

|

Focus |

IFRS |

GAAP |

|

Continuing Education |

CPD required |

CPE required |

Eligibility Criteria:

ACCA Eligibility:

Students with the below-given qualifications are eligible for the ACCA certification:

- 10th pass out

- 12th pass out (from any stream)

- Graduates

- Postgraduates (MBA, M.Com)

- CMAs, CAs (5+ years of expertise)

- CA Intermediates

- Students from any academic background who are interested in accounting or finance can register for the ACCA course

CPA Eligibility:

The eligibility for CPA exam vary by state in the US, but generally, you need a bachelor's degree in accounting, finance, or business administration.

Eligibility for CPA exams:

- 120 credits (a year in an Indian university generally earns 30 credits)

- Based on foreign academic qualification assessment

- Determined by 55 State Boards of Accountancy

Eligibility for CPA license:

- 150 credits

- 2 years of work experience

- Fulfillment of 4 Es (Education, Experience, Examinations, Ethics examination)

- License is to be attained within 3 years of clearing all exams

Job opportunities:

ACCA |

CPA |

|

Individuals with an ACCA qualification can apply for roles such as internal auditors, managers, financial accountants, tax specialists, managers, consultants, and so forth. |

After completing the course, students can pursue careers as internal auditors, forensic accountants, public accountants, and financial analysts, among others. |

ACCA vs CPA Salary:

ACCA |

CPA |

|

ACCA pay in India varies based on years of experience and the most sought, from INR 6.4 LPA to INR 16.7 LPA. |

In India, the pay for a CPA professional can vary between INR 5.9 LPA (less than one year of experience) to INR 24 LPA (ten to nineteen years of expertise). |

To learn more about ACCA and CPA salaries, check out the links below:

Is CPA or ACCA better? - Choosing the Right Course

ACCA and CPA are both well-recognized accounting qualifications, and deciding which one to pursue can be daunting. The tables above highlight some key features of both credentials. When comparing the two, the key question to ask is: Which is better—ACCA or CPA? Both certifications have their merits, but the right choice depends on your career goals and the specific benefits each qualification offers.

- It can be difficult to choose between any two career programs and declare one the winner. After comparing ACCA and CPA, we discovered that each course needs to provide something special and distinct.

- Both ACCA and CPA provide professionals and recent graduates with good employment options. While CPA is more applicable in the US market and concentrates on American accounting rules and principles, ACCA provides a more comprehensive worldwide viewpoint.

- In the end, the candidate has the final say because of the stark differences in the course duration and structure. If you're thinking about doing one of these accounting courses, be sure to compare the ACCA and CPA programs and select the one that best suits your professional objectives.

Choosing the right course can be tiring and hectic with no knowledge about the courses, join the best coaching for commerce and learn!

Read More

- How to Become an Auditor?

- Best Finance Courses in India

- What is Capital Budgeting and its Process?

- Best Accounting Courses in India

- Types of B.Com Courses in India

Frequently Asked Questions (FAQs)

Which is preferable, CPA or ACCA?

It all relies on your professional objectives. While CPA may be regarded as more distinguished in some places, ACCA is typically thought to be more internationally recognized.

Which is more useful in India, ACCA or CPA?

In India, ACCA and CPA are both highly regarded. ACCA's worldwide reach, however, may give you an advantage over international corporations.

Which pays more, CPA or ACCA?

The pay for a given role and level of experience might vary. While CPA wages can reach greater levels, there is generally not much of a difference between the two.

Can I do both ACCA and CPA?

Yes, in theory, but it would require a lot of work. You would have to take your financial and time commitment into account.

Which is more challenging, CPA or ACCA?

When comparing the ACCA and CPA exams, there are several things to take into account. Both tests are difficult, and passing them requires perseverance and hard study. The typical pass rate for CPA is between 40 and 50 per cent, compared to approximately 55 percent for ACCA.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

salary.jpg)

.webp)

.webp)

.webp)