CMA USA vs CMA India: Which One Best Fits Your Career Goals?

Last Updated On -29 Jan 2026

Students frequently have questions about the US CMA vs CMA India. These differ in several ways, including the conducting body, course duration, and syllabus. If you're not sure which one to choose, this blog is for you.

What is the US CMA?

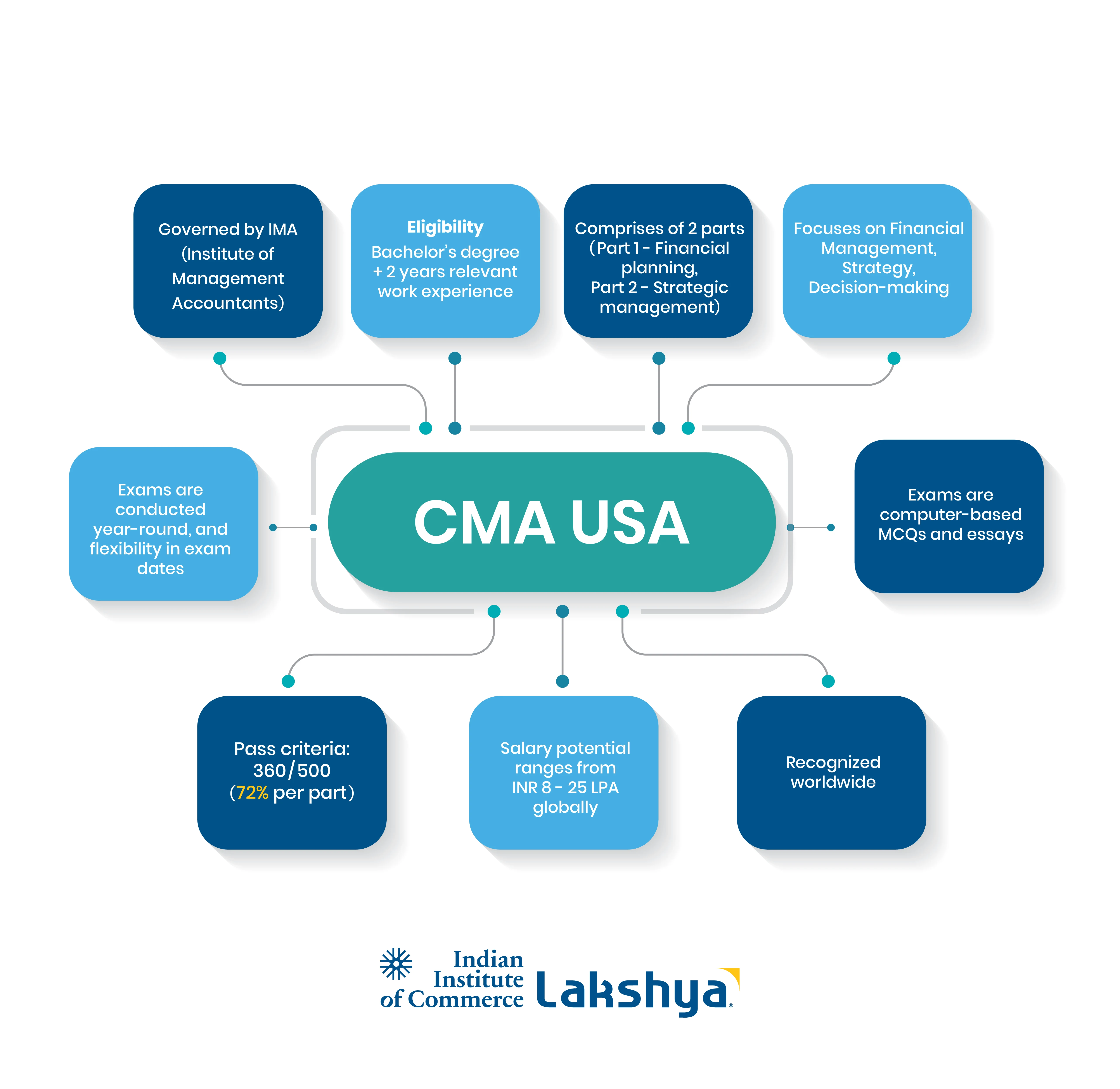

CMA USA (Certified Management Accountant) is a professional management accounting certification offered by the Institute of Management Accountants (IMA) in the United States. It's a globally recognized credential. CMA demonstrates proficiency and dedication in the field of financial management and management accounting. It can lead to a progressive career and better job opportunities.

What is CMA India?

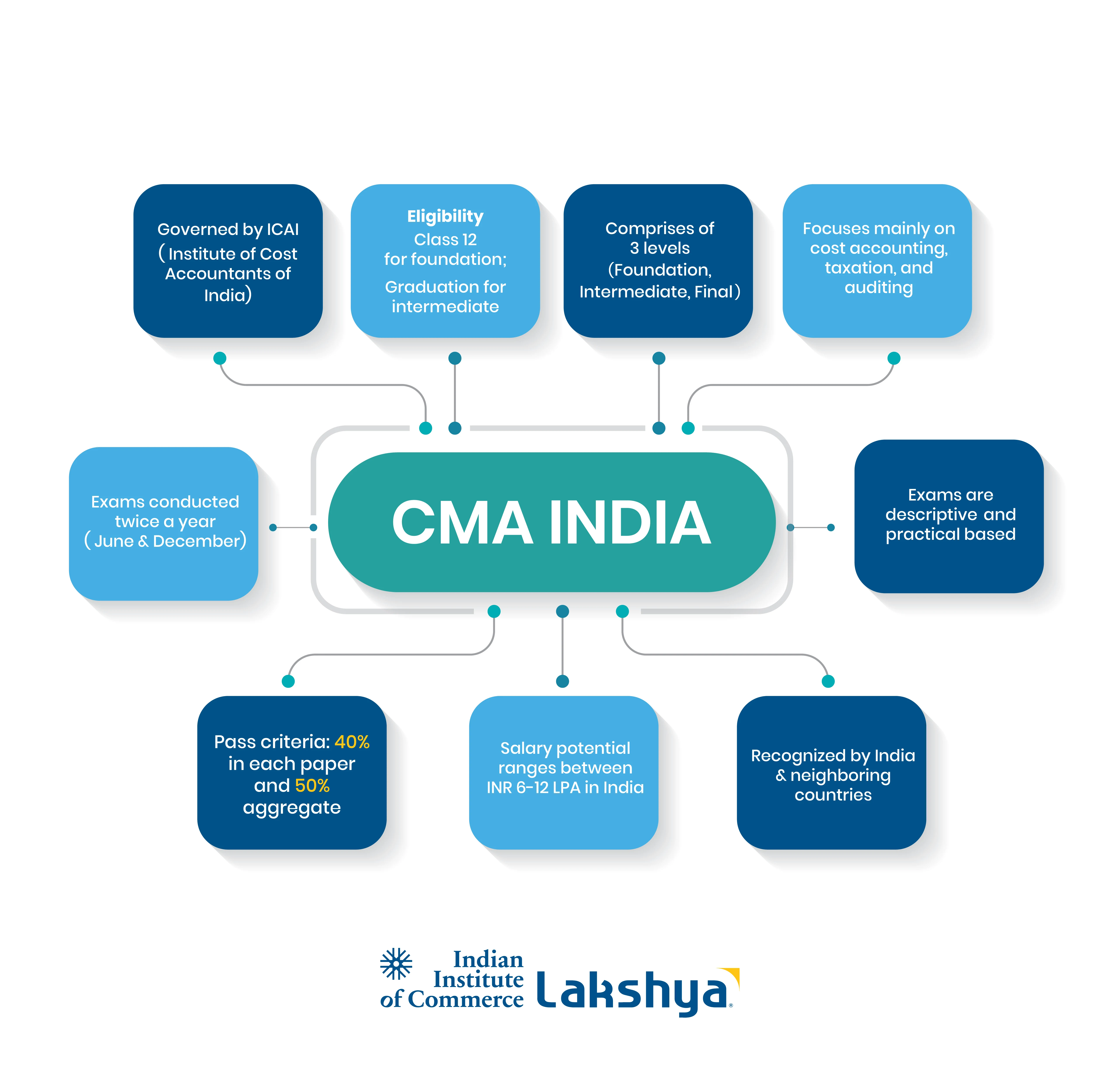

CMA India is an acronym for "Cost and Management Accountant" in India. The Institute of Cost Accountants of India (ICMAI) offers a professional certification program. It is intended to demonstrate competency in analysis, financial planning, control, professional ethics, and decision-making. US CMA is designed on the lines of the Chartered Accountancy (CA) course of India.

Difference Between US CMA and CMA India

CMA programs in India and the United States equip students with the knowledge and skills necessary to excel in financial accounting and strategic management. However, these courses differ in a variety of ways. To decide CMA India or CMA USA, which is better, the key differences between the two are highlighted here:

Feature |

CMA US |

CMA India |

|

Administering Body |

Institute of Management Accountants (IMA) |

Institute of Cost Accountants of India (ICMAI) |

|

Focus |

Financial planning, analytics, strategic decision-making |

Cost accounting, management accounting |

|

Course Duration |

6 to 9 months |

3 years |

|

Eligibility |

Undergraduate degree + work experience |

Class 12th + 6 months articleship |

|

Recognition |

Global |

Primarily in India |

|

Exam Structure |

2 parts (1 level) |

3 levels with 20 papers |

|

Articleship |

Not required |

Mandatory (6 months) |

US CMA VS CMA India - Salary and Job Positions

US CMA salary in India varies according to experience, industry, region, and company.

- Average starting salary: INR 6 lakh per year

- Experienced professionals: INR 12 lakh to INR 25 lakh or more per year

- Highest earners: INR 30-35 lakh per year

Job positions:

- Accountant (INR 8-13 lakh per annum)

- Management Accounting Analyst (INR 9-13 lakh per annum)

- Financial Consultant (INR 6-10 lakh per annum)

- Reporting Analyst (INR 5-8 lakh per annum)

- Financial Advisor (INR 10-20 lakh per annum)

Companies:

- Larsen & Toubro (INR 8.3 lakh)

- L&T Construction (INR 8.3 lakh)

- IQVIA (INR 5-6 lakh with 2+ years of experience)

US CMA holders enjoy a stable financial future and the potential to advance in their jobs. The yearly CMA US salary in India ranges from INR 6 lakh to 25 lakh per year. Professionals with years of work experience receive up to INR 30 lakh annually.

Is CMA US Better Than CMA India?

To summarize, both the CMA US and CMA India certificates are widely recognized and demonstrate proficiency in management accounting and financial management. However, there are some significant distinctions between the two certifications that may impact a candidate's choice of which one to pursue. The CMA US examination emphasizes financial management and decision-making, whilst the CMA India exam covers costing and management accounting. The CMA US examination is more challenging and may be more appropriate for industry veterans, whilst the CMA India examination is more accessible to beginner students.

The job market for CMAs also varies, with the CMA US being more advantageous for applicants searching for jobs in management accounting, whereas the CMA India may be more appropriate for candidates looking for entry-level positions or those looking to work across multiple fields in India. Finally, the choice of CMA US or CMA India, which is better, should be based on the candidate's personal objectives, career goals, and financial constraints.

Read More:

- Best Finance Courses in India

- CMA USA Salary in India

- Career After CMA USA

- What is Financial Modeling?

Frequently Asked Questions (FAQs)

Can I do CMA US following CMA India?

Yes, it is feasible to do CMA US following CMA India. However, it is crucial to know that the CMA US exam is more difficult and more expensive than the CMA India exam. If you have finished CMA India, you are entitled to take CMA US, and you may also receive credit for your job experience. It is recommended that you consider the advantages of having both certificates against the increased expense, time, and effort required to pass the CMA US exam.

Is CMA USA difficult to pass?

The CMA US exam is challenging and has a low pass rate. A global average of 50% for both parts. The exam tests candidates' knowledge in financial planning, analysis, control, and decision-making. It consists of two 4-hour parts. The first focuses on financial statement analysis and the second on decision-making and risk management. With proper preparation, passing the exam is possible.

Is CMA India internationally recognized?

The CMA India certification is internationally recognized, but it may not be as well-known or commonly accepted as the CMA US certification. The CMA India is more prominent in India and Asia, and it is recognized by many organizations and enterprises there. However, it may not be as well known in other parts of the world, such as the United States and Europe. That being said, having a professional certification, such as CMA India, can be beneficial in any place because it displays a degree of experience and knowledge in cost accounting and financial management that can be useful in any industry or sector.

Can Indian CMA work in the United States?

An Indian CMA can work in the United States, however the task may be more difficult than for a CMA US holder. The CMA US is more widely recognized and regarded in the United States, and it is the recommended credential for management accounting and financial management roles there. The United States has its professional accounting bodies. They are more widely recognized in the country than the Institute of Cost Accountants of India (ICAMI). However, an Indian CMA holder can still find employment in the United States, particularly in Indian corporations or organizations with a presence in India.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

salary.jpg)

.webp)

.webp)

.webp)