12 LPA

20+ LPA

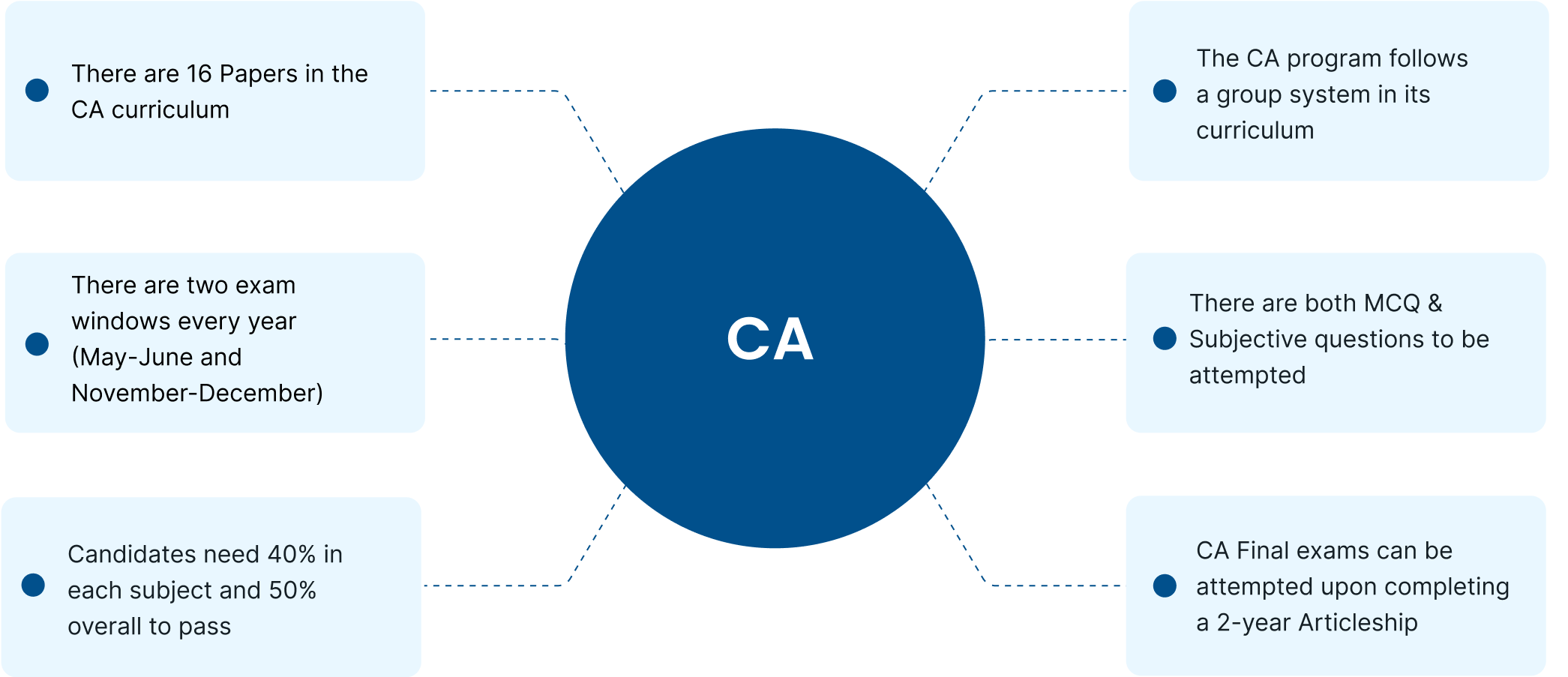

The CA course stands out as the supreme choice of aspiring students worldwide; numerous students and working professionals enrol for the course each year to become Chartered Accountants. The Chartered Accountancy (CA) program in India is governed by the Institute of Chartered Accountants of India (ICAI).

Chartered Accountants have numerous esteemed job prospects in India and abroad, offering attractive salary packages. As a CA, you have the flexibility to either establish your independent practice or secure positions in the financial departments of various firms and companies.

Getting ahead on your CA journey straight after completing the 12th grade helps you to establish a successful career very early. The CA program, known for its inclusivity, welcomes young enthusiasts from various academic backgrounds to delve into the world of CA and equips them with the authoritative power to become finance leaders. The qualification unfolds in three progressive levels: CA Foundation, Intermediate, and Final, with each stage featuring a series of exams complemented by hands-on practical experience that enables the candidate to hold the prestigious professional designation within 4- 5 years.

At IIC Lakshya, we transcend the role of guides in your CA journey; we become your companions in knowledge acquisition, skill development, and personal advancement. Our ultimate aim is to prosper CA aspirants toward success through valuable guidance, empowering them to flourish as accomplished professionals. With a meticulously crafted curriculum and a team of exceptional faculty members, we proudly stand as the go-to destination for aspiring finance professionals.

If CA is your aspiration, we are here to champion your dreams.

Step into the realm of CA! Beyond being a mere certification, it's a distinguished qualification with global recognition, offering you a wealth of skills and knowledge. Brace yourself for an enriching journey that paves the way for your success!

CA Foundation is the gateway to the Chartered Accountancy course, functioning as its entrance examination. It's an inclusive opportunity, open to students from any academic background or stream. Notably, graduates and postgraduates receive an exemption from the CA Foundation and are granted direct eligibility for CA Intermediate. The CA Foundation Course spans around six months. To be eligible to attempt the exam, you should have passed your class12th exams from a recognized board.

This paper will enhance your understanding of fundamental accounting concepts and principles. It aims to empower you to construct financial statements efficiently, address basic accounting principles, and align them with challenges in accounting.

The key objective of this paper is to help students understand crucial aspects of specific business laws and equip them to tackle real-world issues related to these laws.

This part is designed to assist you in developing an understanding of the essential mathematical and statistical tools that should be applied in business, finance, and different economic scenarios. It also aims to improve your logical reasoning skills and use them to solve problems that may arise in your professional journey. The syllabus is divided into three major areas.

Business Mathematics:

Logical Reasoning:

Statistics:

The primary goal is to aid your understanding of essential concepts and theories in Business Economics, enabling you to apply them to solve practical problems in everyday scenarios.

If you think CA, Enrol with Lakshya!

Choose CA and Step into a world of possibilities.

Opting for the CA course opens doors to a prestigious professional career. Qualified Chartered Accountants can work in higher positions upon completing the course and even have the chance to work as an external auditor and embrace the ultimate signing authority.

Experience substantial financial rewards as a Chartered Accountant, with the potential to earn competitive salaries ranging from 12 to 15 LPA in 4-5 years. The CA qualification is critical to unlocking senior roles in esteemed firms, offering a pathway to a successful and fulfilling career journey.

Embark on your CA journey with the flexibility to learn anywhere, anytime. The CA course accommodates your schedule with various study options, including online classes, offline classes, and hybrid modes. This adaptability ensures you can seamlessly balance your work commitments while pursuing your CA qualification.

12 LPA

20+ LPA

Chartered Accountancy certification is one of the most prestigious certifications that enables an aspirant to lead a highly esteemed professional career.

Earn Your Certificate

Learning Modes

Offline Classes

Experience the lively classroom setting in person. Connect with instructors and classmates personally, engage in face-to-face interactions, and get instant feedback for an enriching learning experience.

Online Live Classes

Discover the wisdom of our skilled educators, no matter where you find yourself physically. Immerse yourself in live discussions with teachers and fellow learners, creating a vibrant, teamwork-infused learning journey.

Hybrid Classes

Combine the convenience of online learning with the personalised touch of live sessions. Dive into the core concepts with recorded lectures and enhance your skills through engaging practice sessions guided by experienced instructors.