12 LPA

18 LPA

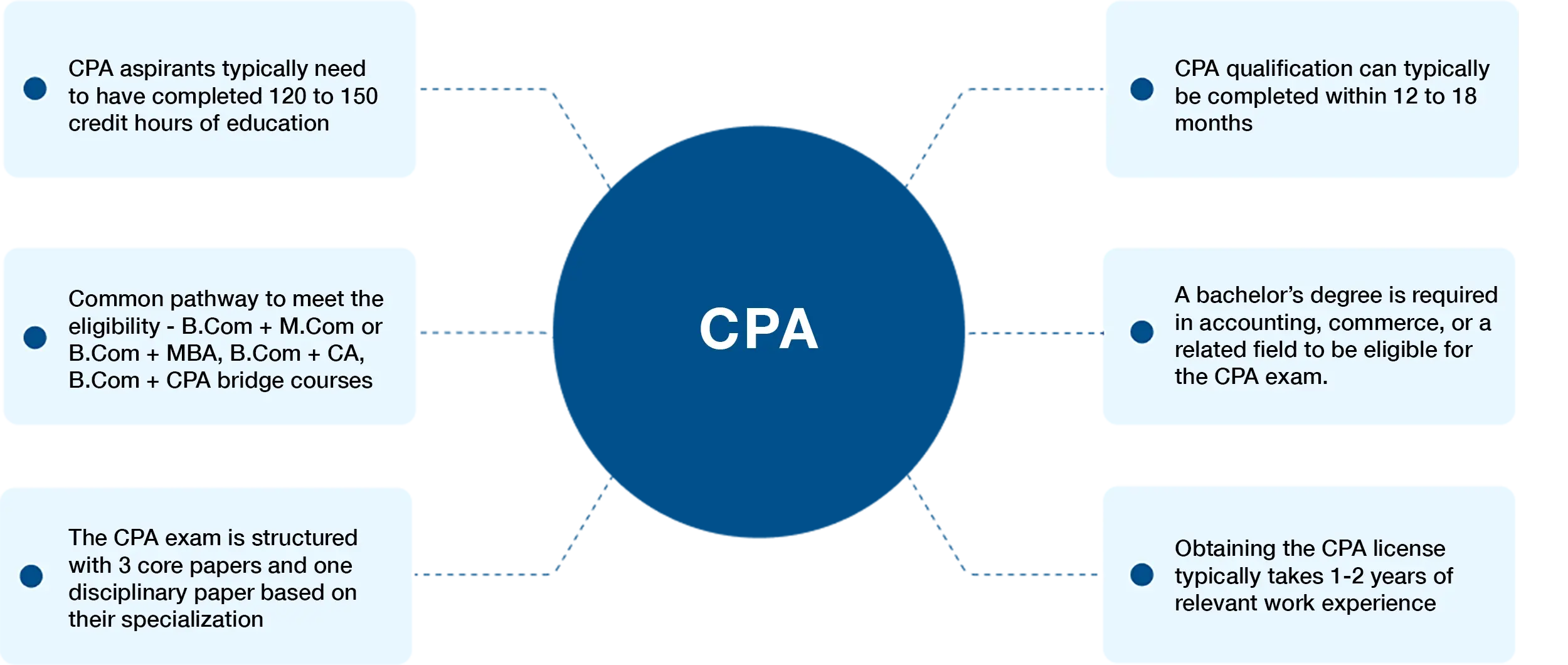

The CPA (Certified Public Accountant) designation is a globally recognized certification in the field of accounting and finance, administered by the American Institute of Certified Public Accountants (AICPA). It signifies expertise in accounting, auditing, taxation, and business law, and is highly regarded in both public and private sectors.

At IIC Lakshya, we offer a structured CPA preparatory program, tailored to support your learning journey through expert guidance, flexible study options, and a team of seasoned faculty members. Whether you're studying full-time or balancing your career, our program adapts to your needs with online and hybrid study formats, extensive practice materials, and dedicated support.

Our commitment to excellence has made us a finance and accounting education leader. As a CPA aspirant, you’ll benefit from a comprehensive learning experience that not only prepares you to clear the exams but also ensures you're ready for a successful career in accounting

Step into the world of CPA! This highly respected certification provides you with essential skills in accounting, auditing, and financial management. The CPA syllabus is a comprehensive guide to mastering these fields, preparing you for a successful and rewarding global career in finance.

The Core sections are Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulations (REG).

Choose CPA & Let your Global Career Take Flight!

Stay current with industry trends and changes through ongoing learning opportunities.

Connect with a global community of accounting professionals and industry leaders.

Access a wide range of roles in public accounting, corporate finance, and consulting.

A CPA is your ticket to work with leading firms worldwide.

12 LPA

18 LPA

The CPA certification is administered by the American Institute of Certified Public Accountants (AICPA) in partnership with the National Association of State Boards of Accountancy (NASBA). While the AICPA is responsible for developing and maintaining the exam content, NASBA - majorly act as a clearing house for CPA.

With CPA credentials, you can demonstrate your expertise and commitment to excellence in the industry.

Earn Your Certificate

Learning Modes

Online Live Classes

Discover the wisdom of our skilled educators, no matter where you find yourself physically. Immerse yourself in live discussions with teachers and fellow learners, creating a vibrant, teamwork-infused learning journey.

Hybrid Classes

Combine the convenience of online learning with the personalised touch of live sessions. Dive into the core concepts with recorded lectures and enhance your skills through engaging practice sessions guided by experienced instructors.