8 LPA

15 LPA

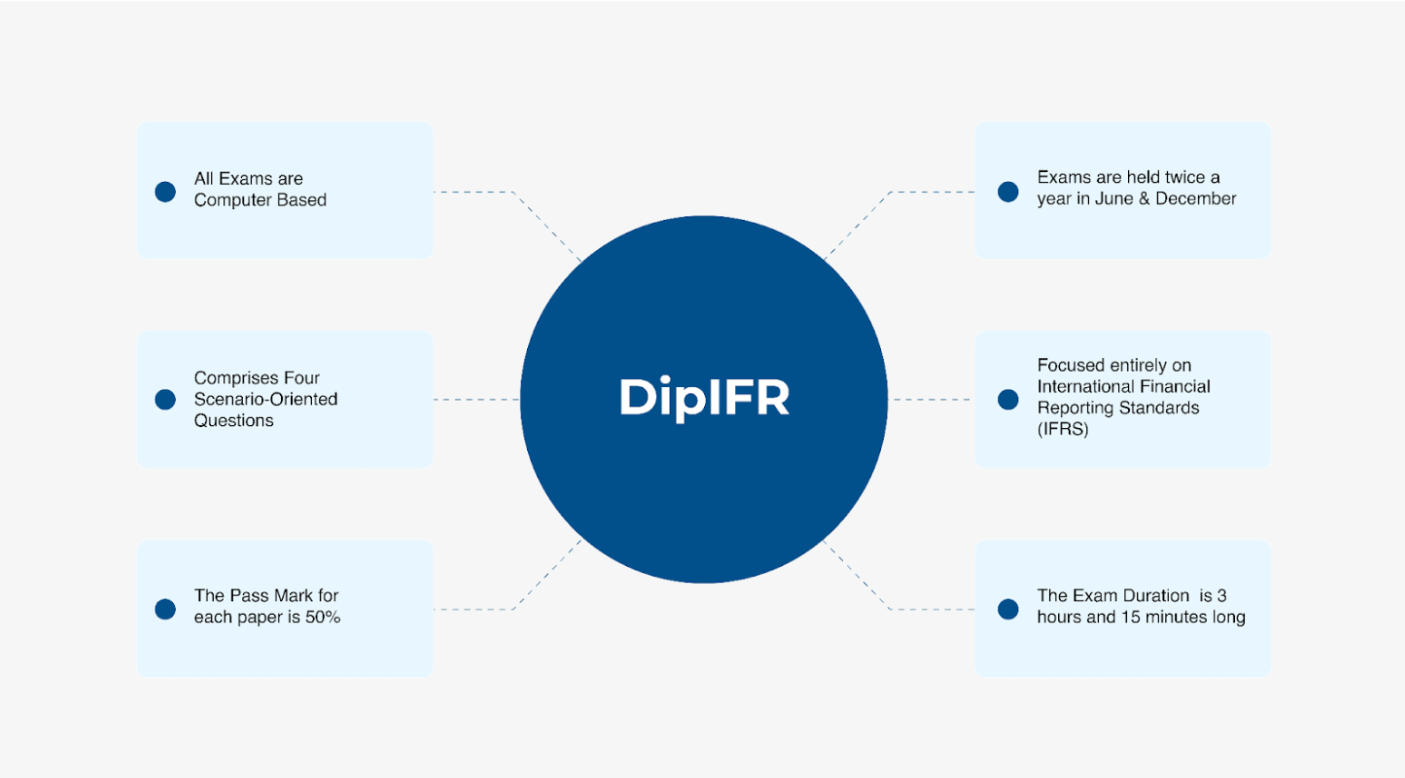

DipIFR is a prestigious qualification offered by the globally recognized body, the Association of Chartered Certified Accountants (ACCA). The complete form of DipIFR is Diploma in International Financial Reporting. Based in the UK, this program enjoys worldwide recognition and is highly valued by professionals seeking to specialize in International Financial Reporting Standards (IFRS). With IFRS certification being adopted in over 140 countries, the DipIFR qualification serves as a powerful credential for finance and accounting professionals seeking to advance their careers on an international stage.

DipIFR is designed to be concise yet impactful, unlike long-duration programs, typically completed within 6 months. It is an ideal program for finance graduates, chartered accountants, MBAs, and working professionals in accounting or auditing roles who wish to deepen their knowledge of IFRS course without committing to a multi-year qualification. By pursuing DipIFR, you gain expertise in areas like financial statement preparation, interpretation, and compliance with global reporting standards, making you a valuable asset in multinational corporations, consulting firms, and regulatory organizations. With a single exam that assesses your understanding and practical application of IFRS, DipIFR provides a focused yet prestigious pathway to upgrade your credentials and global employability.

At IIC Lakshya, we are committed to guiding aspiring finance professionals on their DipIFR journey with structured training, expert faculty, and practical case-based learning. Our goal is not only to prepare you for the exam but also to ensure you acquire the skills to apply IFRS certification effectively in real-world scenarios. As part of the course, you get free access to the BPP Learning material, which includes expert-backed resources, practice questions, and mock exams to enhance exam success. The BPP Learning media is ACCA-approved DipIFR study material featuring structured content and real-world examples for effective learning. It emphasizes an exam-focused approach to simplify complex IFR concepts. Whether you are an aspiring auditor, accountant, or financial analyst, DipIFR with IIC Lakshya can help you build a future-proof career in the global finance arena.

Join us and take your first step toward mastering international reporting standards with confidence!

Step into the realm of DipIFR! This is not merely a short-term credential; it's a highly esteemed international qualification that equips you with essential skills and expertise in International Financial Reporting Standards. Prepare yourself for an extensive experience designed to pave your way to success!

The International Sources of Authority mainly focuses on the International Accounting Standards Board (IASB) and its role in developing and issuing International Financial Reporting Standards (IFRS). You understand the IASB's structure, the regulatory framework surrounding IFRS, and the ethical and professional principles that guide its application.

With DipIFR, let your International Career Elevate!

By earning the DipIFR qualification, you gain specialized knowledge in International Financial Reporting Standards, opening opportunities in multinational companies and global finance hubs across the world.

Professional certifications stand out in the finance industry, often securing roles with better salaries and recognition. A single exam and specialized expertise can significantly enhance your career growth.

Prepare for exams at your own pace with the hybrid mode, where students will receive access to pre-recorded video lectures for self-paced learning. In addition, they will have bi-weekly faculty connect sessions for doubt clearing and continuous mentor support for further guidance. Balance your job and studies seamlessly while building global accounting expertise. Special attention is given through dedicated time for complex topics and revision, followed by mock exams after each section's completion.

8 LPA

15 LPA

Earn Your Certificate

Learning Modes

Online Live Classes

Online Classes: Access DipIFR classes from anywhere in the world with our online sessions. Learn with experienced mentors and collaborate with learners globally. Enjoy the flexibility of learning at your own pace, without compromising the quality of guidance.

Hybrid Classes

Hybrid Classes: Our DipIFR program is designed with a structured support system that ensures consistent progress. Students benefit from biweekly faculty connect sessions for up to 2 hours, along with one-on-one mentorship support and ongoing guidance from coordinators. A daily study plan of 1–2 hours keeps learning on track, while weekly exams reinforce concepts. Special attention is given through dedicated time for complex topics and revision, followed by mock exams after each section's completion. To ensure mastery, students also undergo re-tests for weekly and mock exams, with personalized one-on-one mentor feedback to strengthen performance and build confidence.

Are there any prerequisites for enrolling in DipIFR courses at IIC Lakshya?